I’d be lying if I said that money doesn’t stress me out. I definitely grew up in a household where the value of a dollar was greatly reinforced. While it was kind of annoying growing up (sorry Dad….), I now know how important those lessons were (thanks Dad….).

Living on my own, I’ve been putting the things I was taught growing up into practice. (Although, as a blogger, the concept of buying new clothes to make money is still a little bit unsettling…) I definitely don’t have a problem when it comes to establishing and sticking to a budget, but I loved this idea too much that I just had to share. I spent an hour or so budgeting money for Christmas presents for my friends and family (here’s a gift guide to get you started!) and I wish that I had a magic wallet where the money for presents just existed, you know? This method is the PERFECT way to make sure you have cash to spend at the end of the year for gifts plus plenty left over for actual savings. Or, you know, save all of it. Or… well, I think you can find a way to make it work in the best way for you and your needs and wants.

It’s actually pretty simple and it’s really awesome to see how it adds up. I think this is the perfect method for people who generally struggle to save or saving queens who maybe wants to save up for something special.

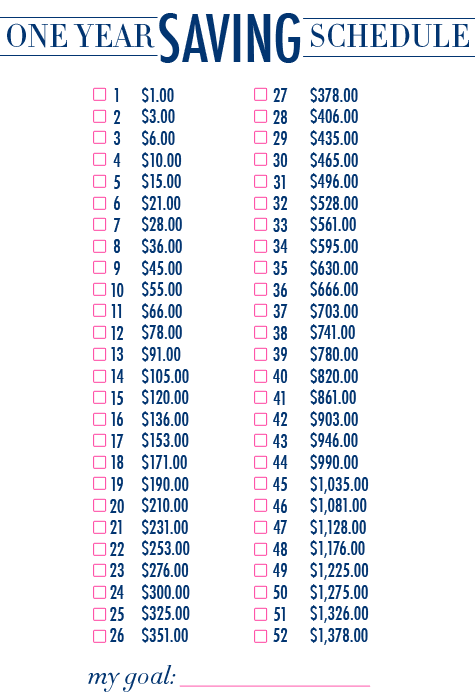

Here’s how it works:

It’s based on fifty two weeks. Every week, you save the dollar amount that corresponds with the week number. On week one, for example, you save $1. On week 32, you save $32. You can either put cash in a jar (save up loose change and bills throughout the week) or set up a special savings account online and transfer the money from checking to savings every week. Compounded, you’ll end up saving $1,378! ($1+$2+$3…. and so on.)

I put together this little graphic so it would be easier to keep track of… plus added the little goal down there so you’re reminded why you’re siphoning off the cash every week. #motivation.

Have you ever tried this method before? What would you save up for?

xoxo

Savings is something I definitely struggle with, but this is such a great tip. I might make this my New Year's resolution, but maybe double it on strategic weeks! Thanks Carly.

I think this is a great idea! And it could easily be tweaked for your needs. For example, I work from April to September; school from September to April. While it would be harder to save when I have no income, I could do this schedule (but doubled/tripled, etc.) when I work. For 16 weeks of work, that would be I've always been more of a splurgier (I blame my gammie, who use to call me to tell me her visa was cleared to go shopping with), but I need to take some more responsibility and save. Great advice!

http://scallopedandbows.blogspot.ca

this is a great idea, I may print out this checklist and use it! I'm not bad about saving, but this would be a great way to have a chunk of extra money to start the year off right! 🙂

daughterofasonofasailor.blogspot.com

This is awesome! I am definitely going to use it. I'll probably use it to save up for a trip somewhere. I've never been to the West Coast and I'd really like to visit someday soon.

I love this idea! I am somewhat addicted to saving. I honestly get a rush every time I see that number go up! I honestly wish more people understood the importance of savings! It is one of the best things you do for yourself!

Great idea! I'm definitely going to use this for 2014. I'm never struggling to save money when there is something expensive I really wan't to have or do. But when I have no goal I tend to spend it all which is a shame :(.. It's always handy to have some back-up money. Also when the goal is to 'big' (like save for a car or a house which are my current goals) I lose motivation quickly.

http://skinnyminisakurina.blogspot.nl

Love this! I'm kind of all or nothing with saving…either I'm in a spending mood or I feel like I should tuck every bit away for emergencies or big goals. This seems like a happy medium!

xo,

Rachel

Suppose Anything Goes

One of the best books I read right out of college was Smart Women Finish Rich; there are a lot of great tips, worksheets and follow up materials that the author provides. If you haven't read it yet, definitely worth the read.

You have no idea how much I needed this. I don't make a lot as a part-time employee, full-time student. I know how important it is to save, and I always heard the "save 20% of each paycheck" rule. So I tried doing that, but after a while, I became stressed because that was just TOO much.

This is such a perfect schedule that I definitely want to try it for 2014! Having enough money by the holidays would be perfect.

Thanks so much for this post!

This…makes very little sense to me. Don't get me wrong, I totally recognize the importance of setting savings goals and sticking to them. I'm a bit of a money nerd so I actually enjoy sitting down to plan out how I can hit goals like topping up my emergency fund, squeezing a bit more into my retirement accounts, or saving for fun trips (fun goals add some instant gratification to the mix and make the whole thing less daunting).

From a cash flow perspective, this particular strategy doesn't make a ton of sense to me. Sure, it would be easy to find an extra $10 to squirrel away in January, but an extra $202 in December would be challenging for most people. Why not just roll a little extra spending money into your annual savings goals and spread the pain evenly across the year?

Finally, people save more when they don't have to think about it. Setting up automatic savings transfers or having part of your paycheck go straight to a savings account makes it seem like the money never existed. That would be much easier than tracking a savings goal that changes every week, no?

I think that the method works for a lot of people who aren't saving-savvy. Luckily for you, it does sound like you are!

The major reason why saving a little bit in January and more in December works is that it allows people to get used to the idea of saving money. Honestly, it doesn't come naturally for some people! So just saving a little bit each more as the weeks go on allows them to build up their "savings muscle." (They don't jump from $10 to $202… it's $10, $26, $42… etc.)

By the end of the year, when they've been saving for 48 weeks, saving bigger chunks of money doesn't "hurt" so much. In fact, they may come to realize that they can actually be saving MORE when the year is up… imagine what their 2015 savings plan might look like then!!

In terms of not thinking about saving, I think that works for people who are used to and already understand the importance of saving. Acknowledging and being aware of the saving (and increasing account as the year goes on) is absolutely part of the learning curve. Probably in the future it could be automatic, but I think there's absolutely something to say about the importance of making the effort every week to reach the goal.

This method is, of course, ONE way to get in the practice of saving… I just think it's a really good beginner's guide to get people in the practice of saving money.

Valid points, thanks for the reply! I can definitely see how building some momentum might help someone get excited about saving once they see their money start to grow. At the end of the day, it's all about tradeoffs, so something that forces savings to stay top of mind could help someone make smart choice when it comes to dinner out with friends versus hitting your goal for the month.

That said, I still think the week by week thing is really tough! You have to make your savings plan livable, otherwise it just won't happen. Some weeks will be easier than others, so I'd recommend allowing for some flexibility and using some light spending weeks to get ahead in case you do have a more expensive week coming up. Having a plan to get to the weekly or monthly goal can make a huge difference! E.g., map out when you know bills are due and when your social schedule might require a bit more cash on hand, and save accordingly.

I had the same thought about finding the extra money in December and I'm actually going to start doing this in January but go backwards – starting with $52, then $51, $50, etc.. I've actually created chart based on my pay days that tells me how much per paycheck and per month I'll be adding for ease and piece of mind – its easier to fit it into my monthly budget excel document in this way, and so I can anticipate the months and pay periods where maybe 3 mondays (my chosen weekday) fall.

In addition to this reverse method, I also have friends who have done $1 one week, followed by $52 the next, then $2 and $51, so you're basically saving the same amount each month. Its an easy enough process to tailor to your needs!

it's great that you've created a visual savings plan — always makes things easier & serves as a great reminder 🙂

I've heard this idea a few times and I love the chart you made! It's hard to believe that just putting away a small amount each week can really make a big impact!

I graduated college this past summer and started working full-time at a "real" job this August and I agree with you about the importance of saving! It's been so fun getting a paycheck for working so hard as opposed to writing tuition checks and still working hard. haha but I keep a budget on Excel (very easy to do btw!) and have been able to save 20-30% of my paycheck a month! If you don't keep a budget, as a 20-something, you definitely should. It's eye-opening to see where your money is going each month and easier to see how much you can save! Thanks for the new idea!!

Snaps for Fourth Grade

Great idea Carly, my wallet has been suffering from all the gifts I've been buying so this would be a great tip to start fresh for next year!

-Alex

http://www.monstermisa.blogspot.com/

Great idea, I am definitely going to try to save more!

http://thepreppysisters.blogspot.com

My husband and I don't make enough money for this to work. But I love the idea of it. Maybe I'll adjust it to a much smaller amount a week.

I love this as a way to save for Christmas presents (or I guess eventually gifts over the year in general as it builds up) so that it isn't a big hit all at once!

Such a good idea! When I am saving for a certain thing, I always modge podge a old glass coke bottle. Then when I babysit, etc. I roll up the money and when I need the money I break it open with a hammer. If you do thing you are guaranteeing that you won't cheat and spend your money early, as you can never get it out of the bottle!

Abby

Thepreppycoxswain.blogspot.com

This is a great idea! I will definitely be using this, but might double the amounts! 🙂

piercegillette.blogspot.com

This looks super practical! I struggle so much with saving/budgeting and it's definitely something to improve upon in the New Year!

Ohh! This is such a good idea:) Super easy to do and who doesn't love saving money?

Ivy and Cedar

Kat

I tried this is January, and it was a little hard to keep up with. Maybe the way I did it was not working out for me. I didn't want to deal with the hassle of transferring money from one account to the other, so I just put cash away in an envelope, but then would be caught up trying to find cash (since I dont really carry a lot on me) and then playing catch up later. This pretty much ended in March.

If you're using a savings account, it makes more sense to put more money away at the beginning of the year, so you receive interest each month. You'll end up with more money at the end of the year then you would if you started with 1 dollar. This strategy works even better if you're saving for bigger things, like retirement. You could save all through your twenties and not save a dime more after age 30, and still have more in the bank then someone who didn't start saving for retirement until their 30s.

I guess it could be a good way to save up for a bigger purchase, but I think using a site like mint.com really helps you figure out how to budget.

Such a good idea!! I definitely need to do this while in college! Spending while be a college student is just not good haha

Annie

A College Confession

I love this idea, it's so easy and mindless. I'll definitely be trying it out!

xo

Tara

shoesillneverhave.blogspot.com

I think a fun way to do this might be to choose one of the amounts on the list each week depending on your current financial situation then cross it off the list. Then when you have extra you can save more, but still end up with the same goal!

This is such a fun and easy idea!

this is great! thanks so much for sharing. saving is definitely something I struggle with…this will be perfect for a holiday gift-shopping budget.

aznstarlette.com

@aznstarlette

Love this and was planning on implementing it for my husband and I as well…so that way we'll double it!! great post as budgeting is never truly fun to do!

http://blovedboston.blogspot.com/

I have been needing to and meaning to get an emergency savings account set up and it hasn't come to fruition. I think partially due to the intimidation factor (what? I need to put away $100 a month, starting THIS month??). This hits the nail on the head…start small and build momentum. By breaking the amounts down, it doesn't seem so scary or impossible. All that said, I might flip it on it's head and do a savings countdown. Just like I like watching time count down on the elliptical at the gym, I think I'll like knowing that each week I "get to" contribute a little less 🙂 Thanks for sharing, Carly!

This is kinda genius. I need to try this!

Mana

Fashion and Happy Things

This is absolutely brilliant! This will definitely be on my new years' list to do for next year!!

This is such a great idea. I never would have thought of it but it's perfect!

This is a REALLY good idea. Regardless of how you tweak it to suit your needs being educated about budgeting and savings is super important. Thanks for the reminder at such an expensive time of year.

Love this. I'm a big saver too – this will definitely be up my alley in the new year 🙂

Liz

Little Moments of Happiness

http://www.littlemomentsofhappiness.com

I've been doing this since half way through 2013, every Monday I transfer the amount from my checking to my savings. I'm off on the week numbers, but it's been awesome! I'm going to start over in 2014.

http://www.etsy.com/shop/preppyinpinkusa

I've been doing this since half way through 2013, every Monday I transfer the amount from my checking to my savings. I'm off on the week numbers, but it's been awesome! I'm going to start over in 2014.

http://www.etsy.com/shop/preppyinpinkusa

Love this! simplyaudrey89.blogspot.com

Okay, this is so smart and so simple. Why don't I do this?!

I'm so excited to try this in 2014! My husband and I are working out a budget that we're really trying to stick to, and I know this will help! 🙂

~Sarah @ 702 Park Project

I want to do my own shedule. It will be nice.. I will share it in my blog maybe tomorrow.

Thank you. It will help me with saving money 🙂